Japan escapes a technical recession as revised economic growth data.

economic growth data.

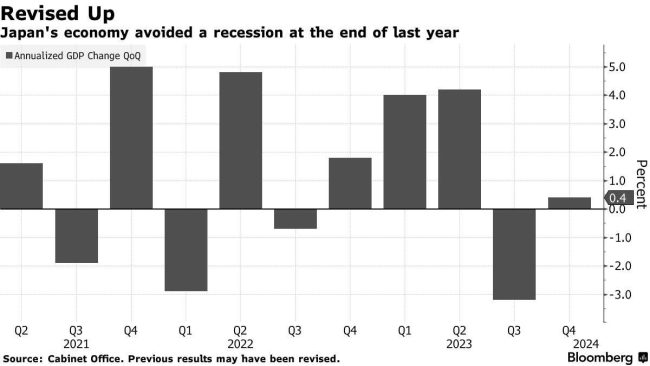

The revised numbers reveal that gross domestic product (GDP) was 0.4% higher in the last three months of 2023 than a year ago.

The economy contracted for a second quarter in a row, according to preliminary data that was published last month.

A technical recession is often defined as the economy contracting for two consecutive quarters.

Nonetheless, the updated numbers fell short of projections. Since some analysts had predicted a 1% increase in the GDP for the fourth quarter.

Hopes that the country had avoided a recession were reinforced last week when the Ministry of Finance reported a substantial increase in the amount corporations invested in their enterprises.

However, numbers released by Japan’s Cabinet Office on Monday revealed that private consumption, which accounts for around 60% of the economy, decreased by 0.3% during the time.

Japan’s inconsistent economic performance may experience another contraction in the current quarter as a result of factors such as a slowdown in neighboring China’s economy and a halt of production at automobile manufacturer Daihatsu.

The increased revision to fourth-quarter GDP comes as expectations rise that the country’s central bank would shortly boost interest rates.

The Bank of Japan has kept interest rates at -0.1% since 2016, when it slashed borrowing costs below zero in an effort to promote consumption and investment.

The value of the yen has decreased as a result of negative rates which deter foreign investors from buying it.

The Nikkei 225, Japan’s primary stock market index, opened Monday morning about 2.5% down.